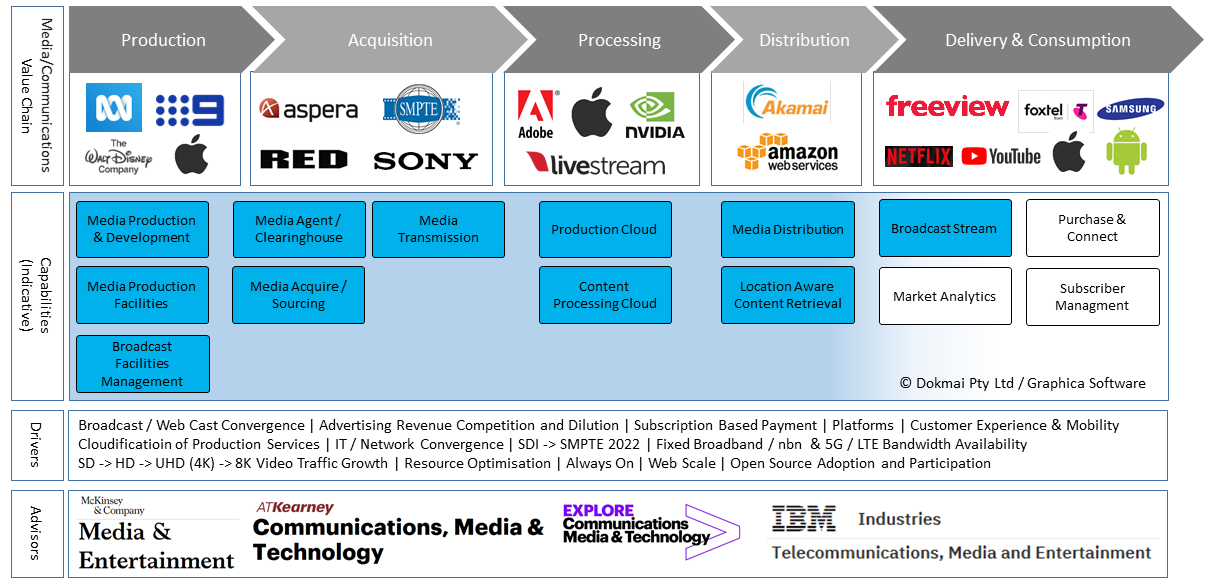

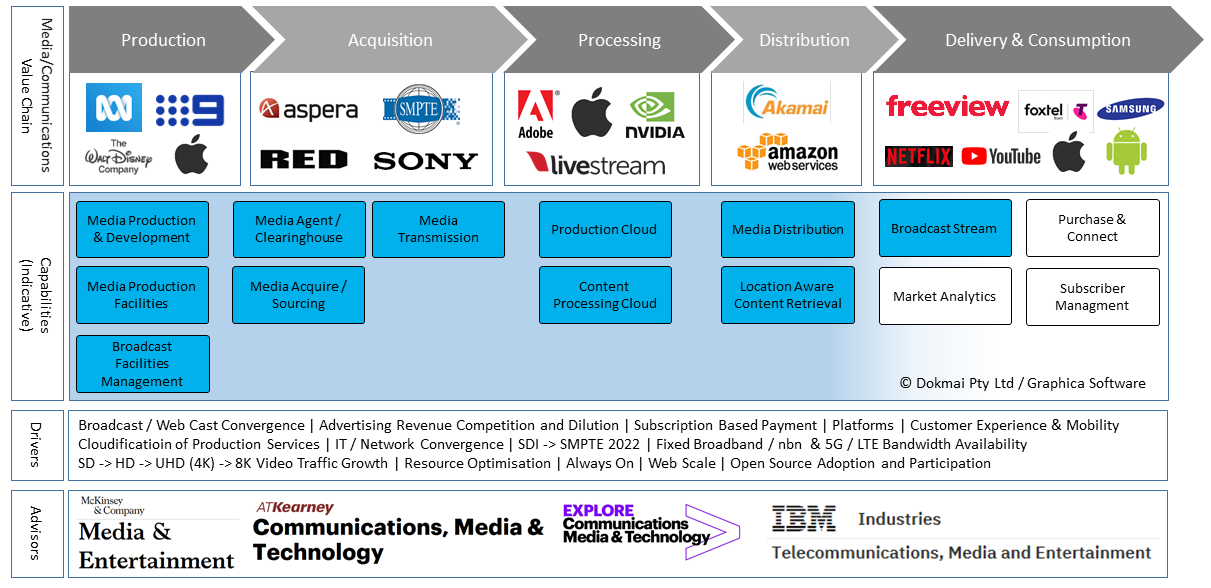

Media & Communications Value Chain

Why do consulting companies bundle media and entertainment with communications as a single industry segment?

The bundling of Communiations, Media & Entertainment industrys together as a sector is now ubiquitous within consulting services. The reason is that communications now plays a central role in content delivery. However the media value chain covers a diverse range of businesses and there are very few large organisations that operates signficantly across all of the value chain. Rather, it is a industry of partnerships and heavy competition.

10 years ago an IBM paper "A Future In Content(ion)" speculatively asked: "Can telecom providers win a share of the digital content market?".

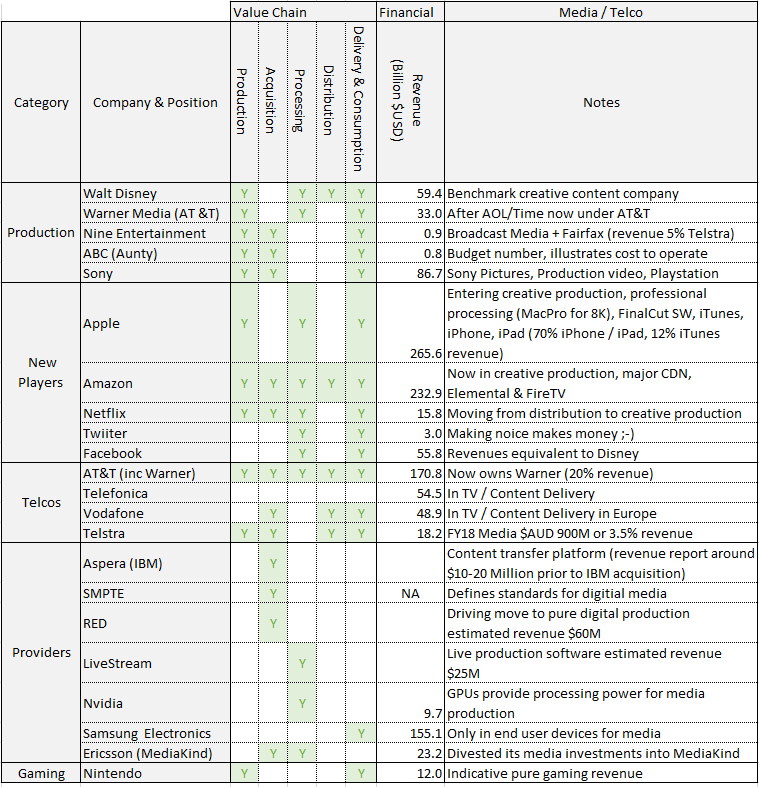

Lets use "a" value chain to review the current state of play. The value chain goes from content creation to consumption:

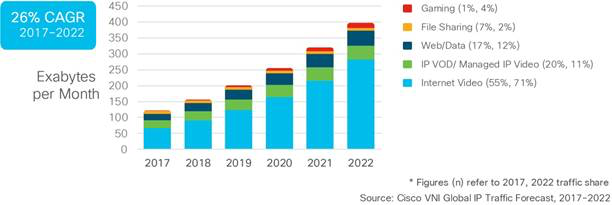

Some might call this is a "Digital Media" perspective. But like many other domains, digital is now a given. Many years ago IBM's Louis Gerstner once said that "all business is e-business" so in the "digital" time one could say that all media is digital. Certainly the impacts of this are still being felt now as traditional media companies and surrounding eco-systems adapt to the new landscape. Communications service providers in turn must respond to the growing bandwith demand that media and video in particular is putting on networks:

The following business drivers are shaping the media & communications:

- Broadcast & Web Cast Convergence - consumers now expect to be able to view their realtime news and sports coverage via TV broadcast or internet delivery on their device

- Advertising Revenue Competition and Dilution - free to air tv must compete with internet content aggregators and search engines. The web players are taking now a larger share of advertising revenue. This is driving need to reduce operational costs and increase diversity of income sources for traditional operators

- Subscription Based Payment - consumers are moving to subscription based payment models for music, movie and serialised tv content

- Platforms - new digital native social media platforms like YouTube, Twitter, Facebook are getting huge audiences all by providing a platform for content distribution and delivery, rather then generating the content itself

- Customer Experience & Mobility - the focus is no longer on providing the content, but also on the overall experience and how this can generate loyalty and contribution into platform. Mobility is no longer mobility out of the home, but within the home as each household is now wired and unwired to allow everyone to have their own private channel

On a technology front there are drivers that both help and inhibit the media content providers and communications companies alike including:

- Cloudification of Production Services - as with other enterprise applications much of the current in-house broadcast production suite are candidates for shift to the cloud. This is especially true for live broadcast which require duplication of production facilities at event sites and in field production vehicles. In digital model ...

- Fixed Broadband and 5G / LTE - will provide ubiquitous high bandwidth communications and technologies like 5G bonding. This greatly simplifies field operations, as field crew can focus on capturing the event and forwarding this as media stream to cloud based production suite. This is consistent with general ..

- IT / Network Convergence - where previously very expensive specialised media and communications technologies are converging onto much lower cost commodity infrastructure with communications by IP networking and ethernet. A trend that the movie industry is driving with ..

- SMPTE 2022 Standards - for media encoding and transmission standards. These will replace bespoke point to point SDI / HDI / 3G-SDI / 6G-SDI, 12G-SDI and other physical network and encoding standards that have evolved over the years to transmit high definition digitial video over in-studio coax cabling. The adoptions of these standards into real time media will require a level of communications reliability that is significantly better that IP and Ethernets "best endevour". Providing this ultra reliable and assured bandwidth will need a new model that is not based on traffic prioritisation schemes that use priority traffic dropping schemes . "Network Slicing" is one candidate which to allow seperation and virtualisation of network infrastructure to provide assured bandwidth allocations to different consuming parties.

While all these new technologies are great for new player making new investments, while for existing player this drives the need for technology refresh programs and learning of new skills to work with these.

This convergence of content with broadcast and internet technologies with constantly growing bandwidth demand as we move from SD to HD to UHD (4K) to 8K will require that the industry adopt architectures that can able to support alway's on operations which can flex with demand as existing web-scale providers such as Netflix and YouTube currently do.

So who are some of the players and who will be the winners in this new environment. Lets look at where to things currently stand by using some candidate participants to see where they fit and how they are performing.

Currently AT&T in USA is the "communications service provider" (CSP) that has taken the biggest bite of the media / content pie, through its aquisition of Warner Media. Locally Telstra continues to try to do media, through its partnerships with AFL & NFL (sports winners), but its other historical bets in traditional media (Trading Post) and most recently digital video platform (Ooyala) have not gone well. Unlike AT&T, Telstra has kept away from creative production and only played in delivery (Telstra TV, Foxtel & Telstra Movies) space.

All of the big new players: Apple, Amazon and Netflix have moved or are moving into creative content production. Apple is just starting and Amazon and Netflix are already steaming serials and documentaries to differentiate there offerings and maintain customers.

Amazon also has AWS Elemental and is big player in Content Delivery Networks (CDN) they are well positioned for adoption of cloud based production facilities.

Sony has creative production, production technology and Playstation gaming assets. It is interesting to look at Sony's revenue, which is across its varied portfolio, relative to more focused organisational such as Disney (content & entertainment) and Nintendo (gaming). Certainly its revenues (proftits in segment requires deeper analysis) show that it is performing well relative to more focused participants.

Facebook, Twitter & YouTube have all shown that you can create value as platform provider without the need to be the content creator.

At the device level Samsung, Sony and Apple are all in the market with Samsung having large handset and TV share.

Apple is now making big moves in movies and content: its Apple Movies announcement, production tools like new Mac Pro which provides ability to support realtime full resolution 8K Video editing and "Final Cut" software. Apple is serious about playing key role in the creative content production work flow. Its displacement of now defunct (in all but name) SGI as go to media tools vendor will be complete then.

Ericsson one of the only telco equipment providers to make forray into media production has now divested its media asssets into MediaKind. This makes sense as some of the network needs for "Cloudification of Media Production" are extremely onerous (lossless, uncontended, extremely reliable, high bandwidth traffic with multicast and precision time protocol support) and not being a telco equipment provider means you do not sign up to the provision of these.

So "can telecom providers win a share of the digital content market?". Currently creative content has continued without support from CSP's and their consumers audiences have turned to the aggregators and distributor's such as NetFlix, Amazon and Apple for their content.

The creative "Production" part of the value chain requires substantially different skills set to what is required to support than the "Delivery and Consumption" part. So mostly CSPs are still in the utility pipe business. The results show that this is still a highly lucritive niche to populate and the battle in telcommunications, has now to providing compelling experience to foster loyality and automated operations.

Focus on experience and automation play's much better into the CSP's core strengths in engineering, rather than in creative production. So its back to the grind stone of hard yakka to get business performance results.

NOTE: Timed to coincide with its FY19 full year financial results Telstra made two interesting announcements:

- It had sold its media production facilities to Gravity Media, which follows a general trend for Telstra that most of what is tries to do with media is not a good fit for it

- Telstra sets up a property trust and sell $700m stake to Charter Hall consortium, as it needs to start to get value from its accomulated assests as core business proves to be an ongoing growth concern

References:

Cisco Visual Networking Index - Forecast and Trends, 2017-2022

Owler - Community Driven Business Intelligence - Red Revenue

Telstra - FY18 Annual Report

Apple - SEC Filings

Wikipedia & Yahoo - Financial & Company Summary Data

VentureBeat - IBM aquires Aspera

AWS Elemental - Amazon acquire Elemental

SGI - The Demise Of Silicon Graphics Explicated By A Structural Functionalist

SDI Video - SMPTE digitial video standards

IBM - Digital Media - A Future In Contention

NOTE 1: see Value Chains - A Tool for Business Architectures in "Just Enough Architecture" pages.

NOTE 2: Author declares that he once had some SGI shares and still owns a few SGI computers ;-)